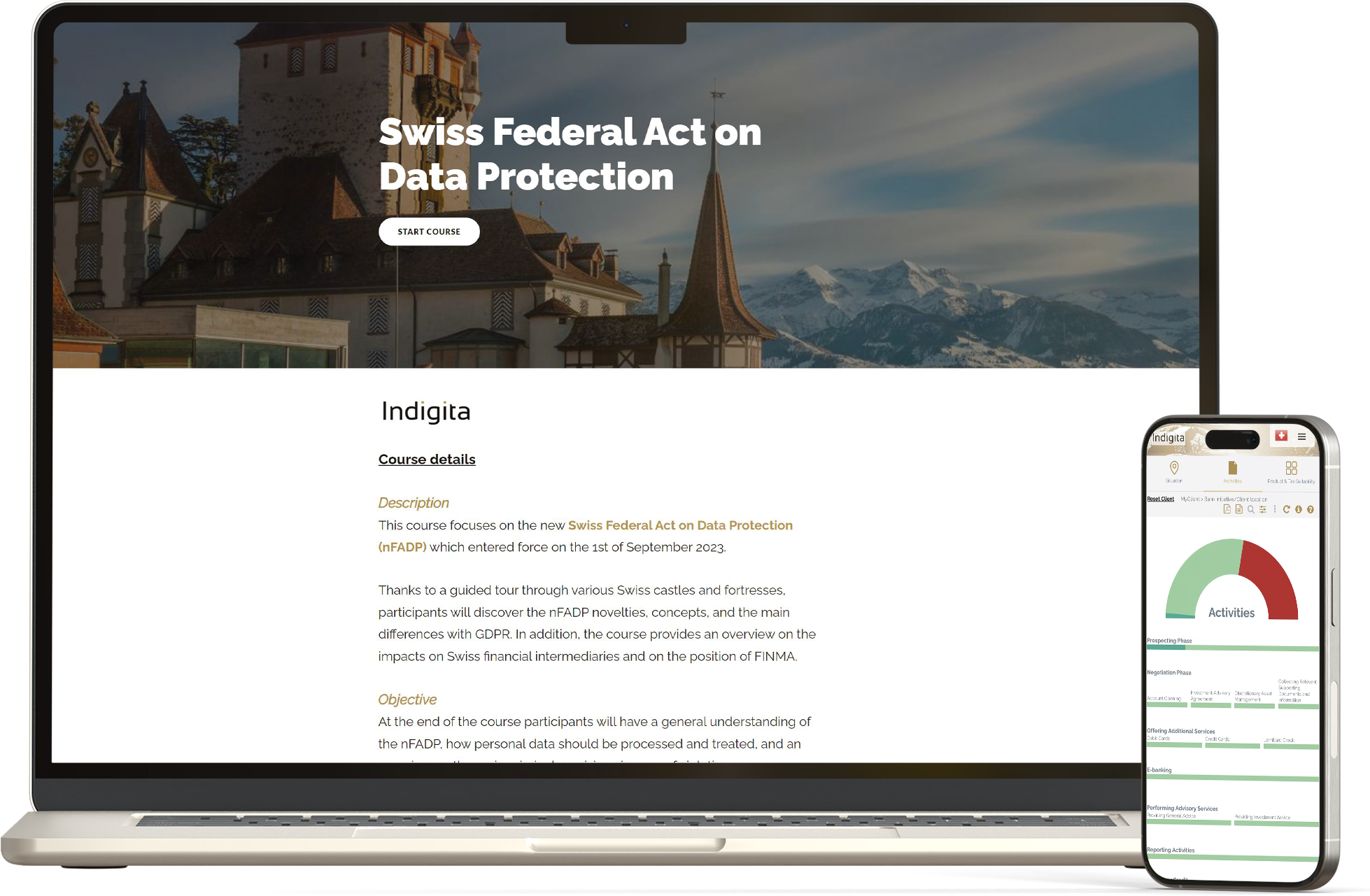

DIGITAL APPLICATIONS, APIs, E-LEARNING

THE SIMPLE DIGITAL WAY TO CROSS-BORDER COMPLIANCE

We empower financial service providers to navigate regulatory complexities, minimize business risk, and safeguard client trust.

OUR SOLUTIONS

Indigita offers a comprehensive portfolio of digital solutions, including digital applications, APIs, and e-Learnings, designed for seamless cross-border compliance.

Our solutions are based on the expertise of BRP Bizzozero & Partners SA, giving you access to industry-leading regulatory guidance in over 190 jurisdictions.

INDIGITA IN NUMBERS

+ 70

Banks

+ 15

External Asset Managers

+ 25

Strategic Partners

+ 25

Experts

OUR MISSION

We understand the complexities and challenges Banks and Asset Managers face in ensuring regulatory compliance and risk management.

Our mission is to simplify this process with innovative, digital solutions tailored to our clients’ needs.

OUR LATEST INSIGHTS

VIEW ALL INSIGHTSJOIN US AT EVENTS

Sorry, no events for now.