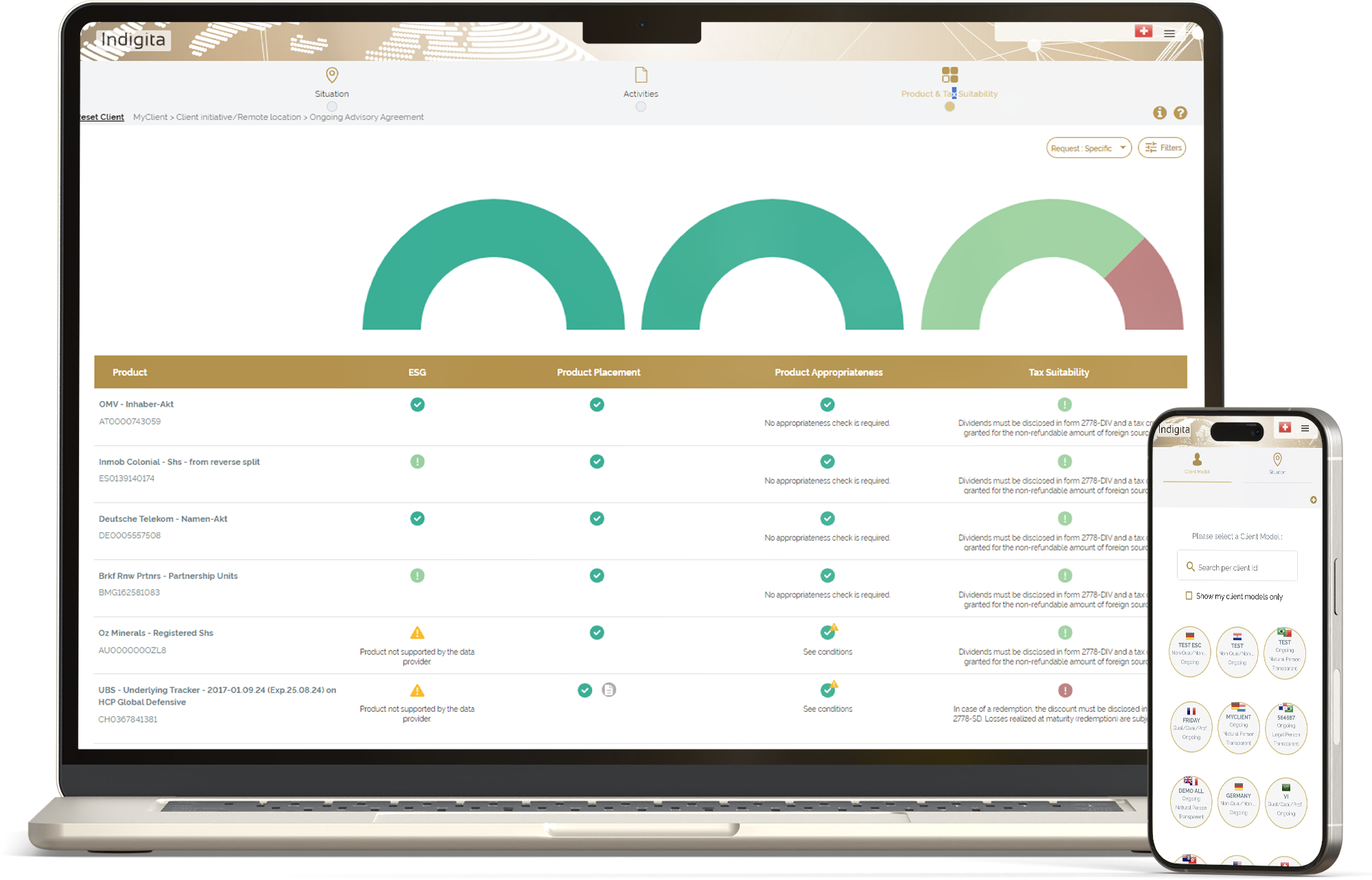

inApp

CROSS-BORDER COMPLIANCE IN CLIENT INTERACTIONS

What makes inApp so powerful?

190+ jurisdictions for private banking services, product placement and tax suitability.

Product placement and tax suitability checks for all asset classes thanks to the ISIN module and data provided by SIX.

Instant verification of financial products as per MiFID II and FinSA thanks to data provided by Prometeia.

Considering client’s investment preferences, provision of ESG scores for financial products through our partnership with Prometeia.

Straight answers on regulatory questions despite complex client profiles and multi-jurisdictional scenarios.

A stand-alone, cloud-based solution hosted in Switzerland.

Export results directly to Excel in XLSX format for faster reporting and deeper insights!

Business use cases

Relationship manager in private banking

READ USE CASE

Private Banking and Cross-Border Communication

READ USE CASE

Product placement & Tax suitability

READ USE CASERegulatory areas covered

PRIVATE BANKING SERVICES

Check whether you’re allowed to provide a certain service to a client or prospect.

TAX SUITABILITY

Check if a product is suitable for your client from a tax perspective.

RESPONSIBLE INVESTMENT (ESG)

Check if a product is suitable for your client from a tax perspective.

PRODUCT PLACEMENT

See if you’re allowed to distribute a product to a client in a specific country, find out whether the product needs to be registered.

INVESTOR SUITABILITY & APPROPRIATENESS

Perform appropriateness checks and controls on regulatory aspects as per FinSA & MiFID II.

sanctioned securities

Check if a product is suitable for your client from an ESG perspective.

KEY PARTNERS

FAQ

To view the cross-border rules in a few clicks, following the entire client life-cycle: from selecting the contractual relationship between the financial institution and the prospect/client, to reviewing the financial products that can be placed and their tax impact.

The inApp is designed for:

– Relationship Managers: To quickly access regulatory information for compliant client interactions across jurisdictions.

– Compliance Officers: To efficiently assess cross-border risks and provide accurate regulatory guidance.

– Top Management: To support strategic decision-making regarding market entry, product offerings, and risk management.

inApp covers approximately +190 jurisdictions which are kept up-to-date, always reflecting the BRP Country Manual updates.

Yes, inApp can be tailored to align with the Client’s preferences and internal strategy. Customization options can include: modifying contract labels, white-labeling, SSO, adding informative messages within the app, personalizing answer formats, and so on.

Yes, inApp is a web-based application making it accessible on any device with an internet connection, including smartphones and tablets.

TALK TO AN EXPERT

Do you have further questions? No problem!

Contact us by phone, email or contact form – together, we will clarify all open questions and advise you on the optimal training solution for your company.